AcceleCom XELE-MD is a market data (MD) acceleration system based on FPGA hardware technology, with sub-microsecond response speed. The FPGA data transmission system provides faster and more accurate information channels with nanosecond response speed. It plays a critical role as a key component in a high-performance, ultra-fast trading system tailored for high-end investors in securities and futures, as well as fund investment firms and industry giants.

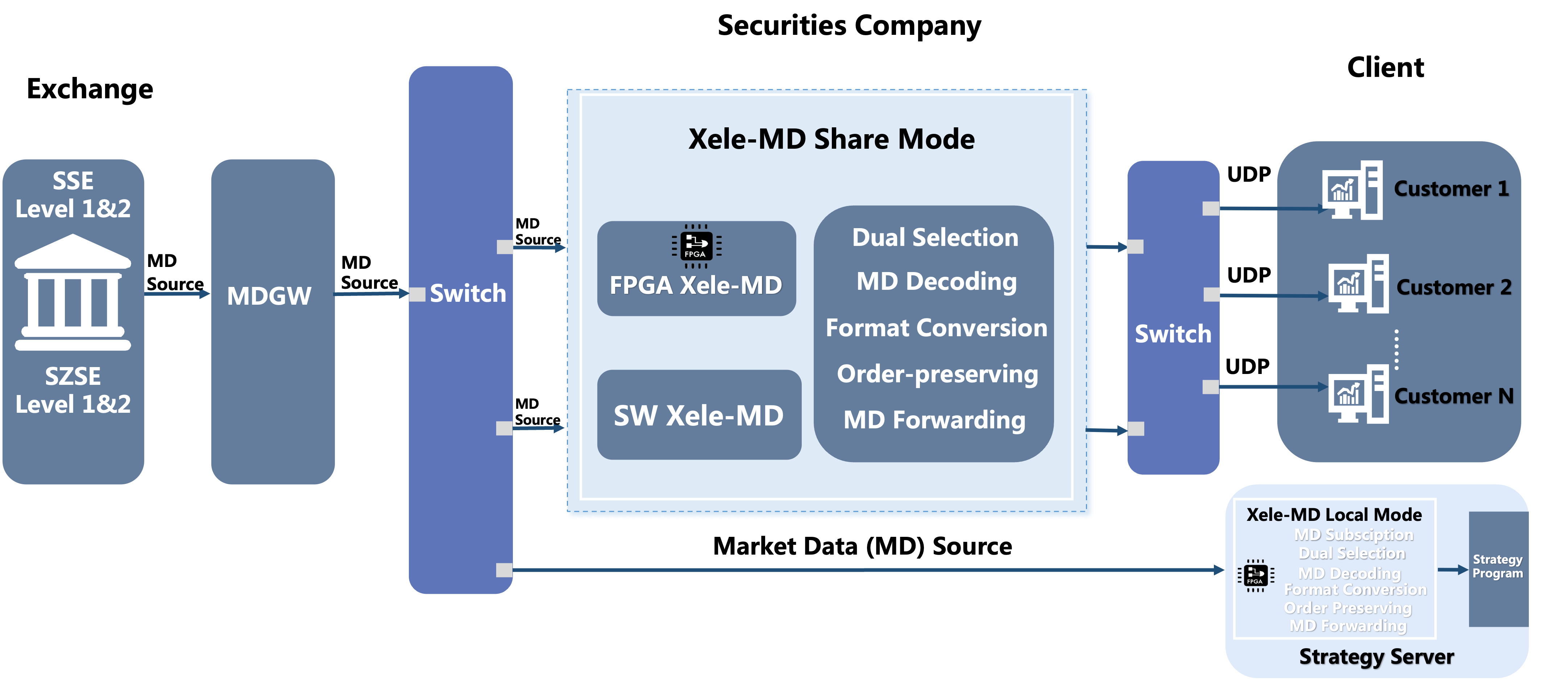

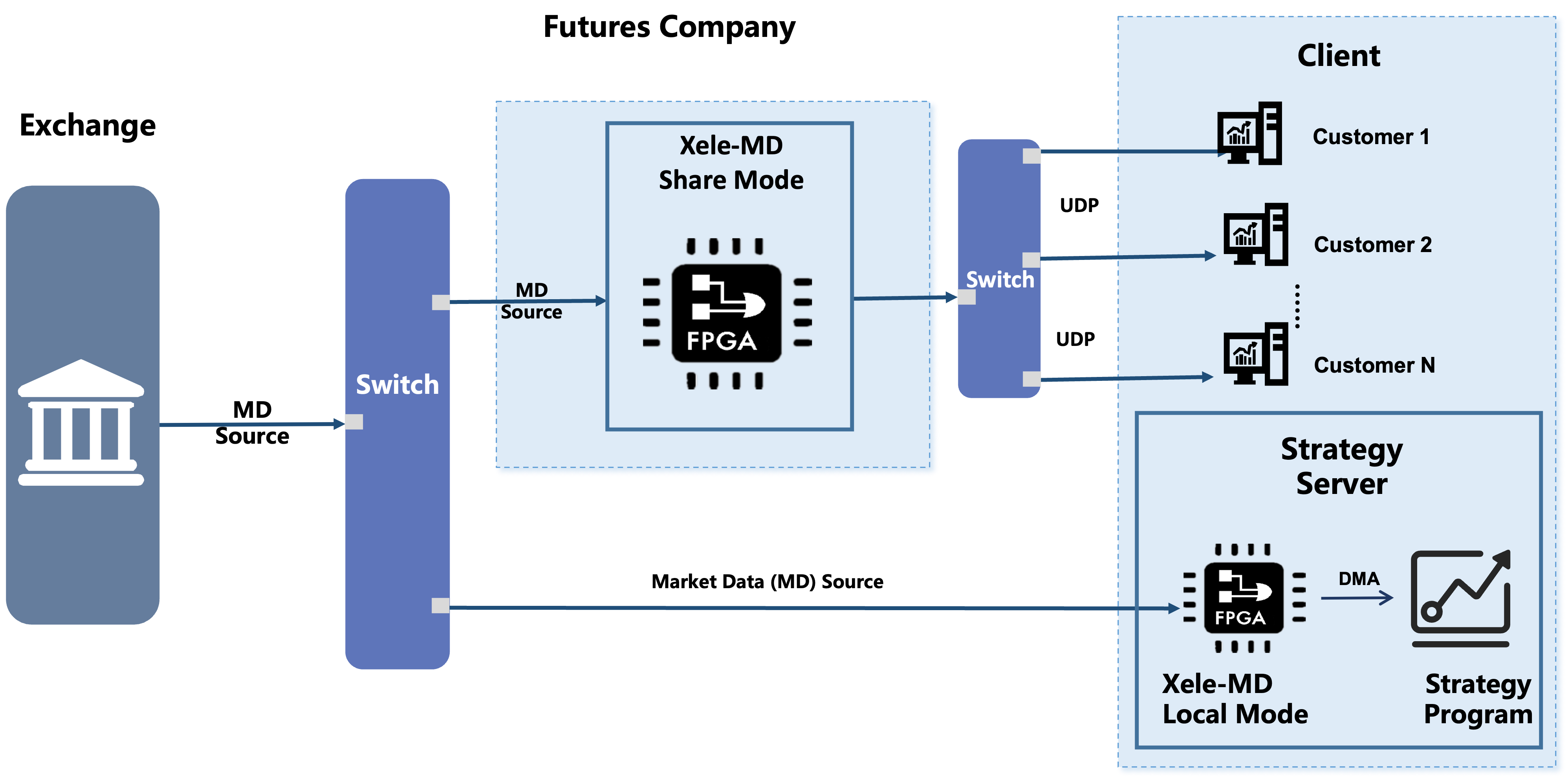

AcceleCom XELE-MD hardware-based MD acceleration system is available in two modes: Share and Local. Both modes are provided for securities and futures markets.

For Share mode of Xele-MD, the FPGA-based MD acceleration system is deployed on broker’s hosting server. It retrieves two channels of market data source from exchanges through a LAN, performing a series of operations such as market data selection & analysis, then forwards the processed market data to clients via UDP multicast.

For Local mode of Xele-MD, the FPGA-based MD acceleration system is directly deployed on user’s hosting server. It retrieves two channels of market data source from exchanges through a LAN, performing a series of operations such as market data selection & analysis, then the processed data will be sent to a strategy program running on the same server. Additionally, it fulfills the demand for subscribing to market data.

XELE-MD for Securities

(Share Mode and Local Mode)

Share Mode

Functional Introduction:

- Dual MD selection: Supports dual-channel market data source input, selects the fastest one for data parsing, including optimal deduplication functionality.

- MD decoding: Decodes received market data according to exchange-specific format specifications.

- Data order preserving: Supports order-preserving processing in cases of out-of-order retransmission of original market data packets from exchanges, ensuring data accuracy.

- MD forwarding: Utilizes UDP multicast to efficiently distribute parsed market data, improving forwarding speed and no time lag among user terminals.

- Hot standby switch: The MD system utilizes a hardware/software mutual backup architecture to enable seamless switchovers in the event of hardware MD failures without any impact on customers, ensuring system stability.

- Proxy forwarding: Supports compression and decompression of market data for efficient remote transmission of data.

Performance Indicators:

- Tick: 500ns

- Snapshot: 1μs

Local Mode

Functional Introduction:

- MD subscription: Supports customized output of required market data based on instrument info, tremendously reducing the quantity of market data processed at the client-side, improving data processing efficiency.

- Dual MD selection: Supports dual-channel market data source input, selects the fastest one for data parsing, including optimal deduplication functionality.

- MD decoding: Decodes received market data according to exchange-specific format specifications.

- Data order preserving: Supports order-preserving processing in cases of out-of-order retransmission of original market data packets from exchanges, ensuring data accuracy.

- MD forwarding: Utilizes DMA channels to transmit market data, eliminating the need for user-side switches, with lower link latency.

Performance Indicators:

- Tick: 400ns

- Snapshot: 1μs

XELE-MD for Futures

(Share Mode and Local Mode)

Share Mode

Functional Introduction:

- Dual MD selection: Supports dual-channel market data source input, selects the fastest one for data parsing, including optimal deduplication functionality.

- MD decoding: Decodes received market data according to exchange-specific format specifications.

- MD forwarding: Utilizes UDP multicast to efficiently distribute parsed market data, improving forwarding speed and no time lag among user terminals.

- Format conversion: Capable of processing and converting the market data message format to lower transmission latency.

- State detection: Utilizes UDP heartbeat mechanism to determine the health of the system link through UDP heartbeats.

- Clear and simple structure: Provides easy-to-use demo cases and output structure descriptions, facilitating integration with investors’ client programs.

Performance Indicators:

- Penetration latency: 168ns

Local Mode

Functional Introduction:

- MD subscription: Supports customized output of required market data based on instrument info, tremendously reducing the quantity of market data processed at the client-side, improving data processing efficiency.

- Dual MD selection: Supports dual-channel market data source input, selects the fastest one for data parsing, including optimal deduplication functionality.

- MD decoding: Decodes received market data according to exchange-specific format specifications.

- MD forwarding: Utilizes DMA channels to transmit market data, eliminating the need for user-side switches, with lower link latency.

- Direct output: No need to go through another layer of switches; it communicates directly with the internal strategy program via DMA.

- Simplified encapsulation: Saves time by eliminating the need to add MAC headers and encapsulate data; only outputs the content.

Performance Indicators:

- Penetration latency: 148ns